Funding Rates are periodic payments made to or by traders who are long or short based on the difference between perpetual contract markets and spot prices.

Unlike conventional futures contracts, perpetual futures contracts give traders the ability to hold positions with no expiration date.

Since perpetual futures contracts never settle, exchanges use funding rates to ensure futures prices and index prices converge on a regular basis.

Funding fees are periodic payments made to or by traders who are long or short based on the difference between the perpetual markets and spot prices.

Go to Binance’s Official Website

Traditional Futures vs Perpetual Futures

A key feature of traditional futures contracts is the expiration date. When a contract expires, a process known as liquidation begins.

Typically, traditional futures contracts are settled on a monthly or quarterly basis. At settlement, the contract price converges towards the spot price, and all open positions expire.

Perpetual contracts are widely offered by crypto derivatives exchanges and are designed with some similarity to traditional futures contracts. Although, perpetual contracts offer a key difference.

Unlike traditional futures, traders can hold their positions without an expiration date and do not require multiple months of tracking for delivery. For example, a trader may hold a short position at his or her discretion unless liquidated. As a result, perpetual trading contracts are very similar to trading pairs in the spot market.

Since perpetual futures contracts never settle in the traditional sense, exchanges need a mechanism to ensure futures prices and index prices converge on a regular basis. This mechanism is also known as the Financing Rate.

What is the financing rate?

Funding rates are basically the stipulated periodic payments to traders who are long or short based on the difference between the perpetual contract and spot prices. Therefore, depending on the open positions, traders will pay or receive funding.

Cryptocurrency funding rates prevent enduring divergences in the price of both markets. This rate is recalculated several times a day: Binance Futures does it every eight hours.

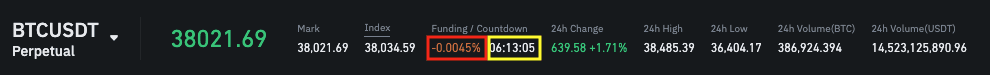

On our Binance Futures platform , the funding rates (highlighted in red) and the countdown to the next funding (highlighted in white) are displayed like this:

Image 1: Funding rate displayed on the Binance Futures platform

Go to Binance’s Official Website

What determines the financing rate?

The financing rate consists of two components: the interest rate and the premium.

On Binance Futures, the interest rate is fixed at 0.03% daily (0.01% per funding interval), with the exception of contracts like BNBUSDT and BNBBUSD, where the interest rates are 0%. Meanwhile, the premium varies according to the price difference between the perpetual contract and the brand price.

In periods of high volatility, the price between the perpetual contract and the mark price may differ. In such cases, the premium increases or decreases accordingly.

A high spread leads to a high premium. Conversely, a low premium will indicate a narrow spread between the two prices.

If the funding rate is positive, the price of the perpetual contract is usually higher than the mark price. Therefore, traders who open long positions pay for short positions. Conversely, a negative funding rate means that short positions pay long positions.

Financing fees are paid peer-to-peer. Therefore, Binance does not receive commissions from funding fees as they are processed directly between users.

How does this affect traders?

The financing calculation considers the amount of leverage used, the financing rate can lead to an impact on the profits and losses of each. With high leverage, a trader who pays the funding fee may suffer losses and be liquidated even in low volatility markets.

On the other hand, raising the financing can be very profitable, especially in range-bound markets.

Hence, traders can develop trading strategies to take advantage of funding rate and profits even in low volatility markets.

Essentially, funding rates are designed to encourage traders to take positions that keep futures contract prices in line with those in the spot market.

Visit Binance’s Official Website

Correlations with sentiment around the market

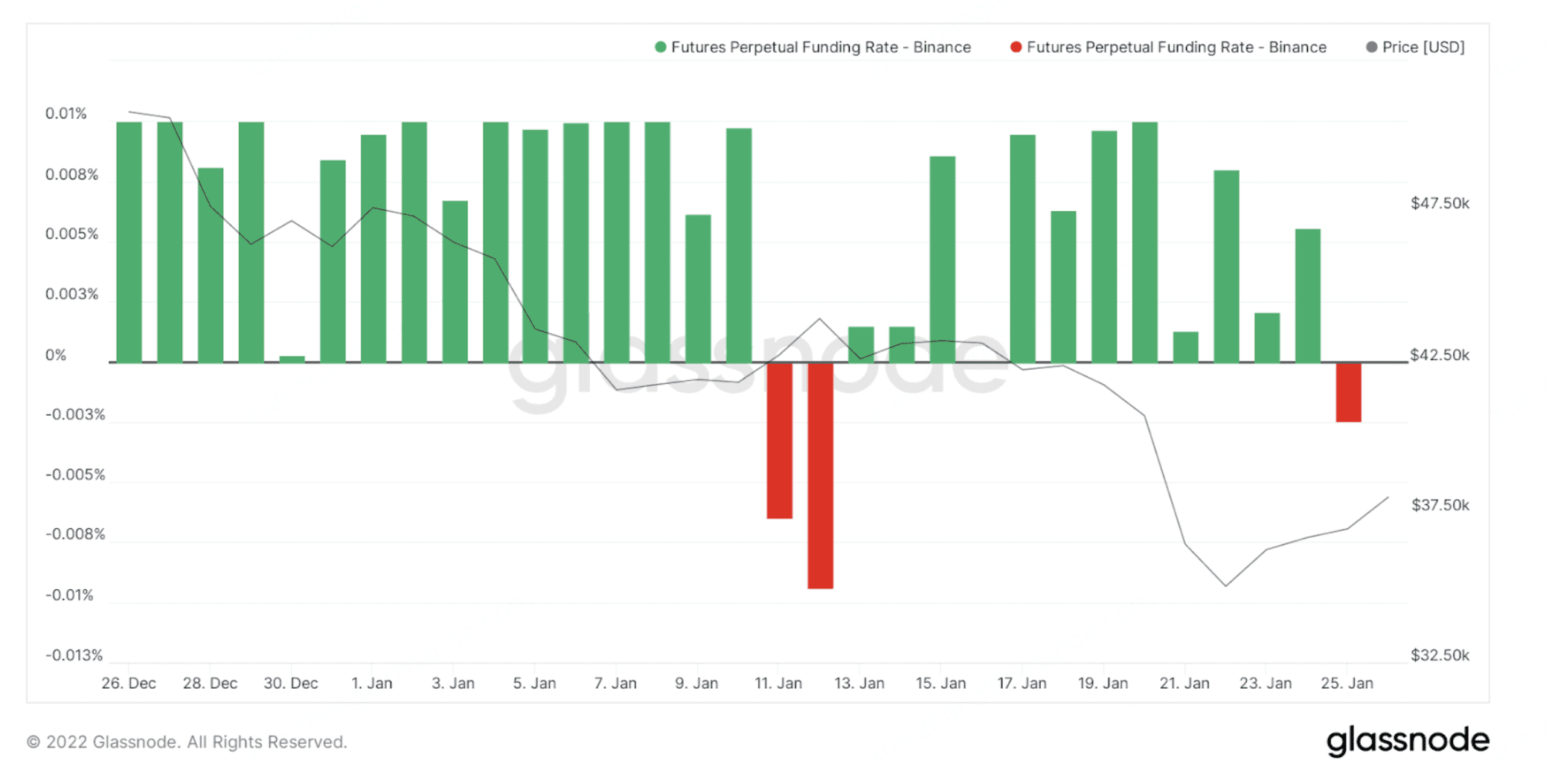

Historically, cryptocurrency funding rates tend to correlate with the general trend of the underlying asset. The correlation does not indicate that the financing rate determines the spot markets, but rather that the reversal is real. The following chart shows the correlation between the funding rate and spot BTC prices over a 30-day period:

Chart 1: Correlation between funding rate and price changes in BTC

As shown in Chart 1, funding rates doubled as BTC prices rallied since the start of the year. The high financing rates represented a sign of confidence in the market about a greater possibility of an increase. Still, many traders took notice of increased funding fees, which helped bring futures prices in line with spot.

Historical comparison of the funding rate on other crypto-derivatives platforms

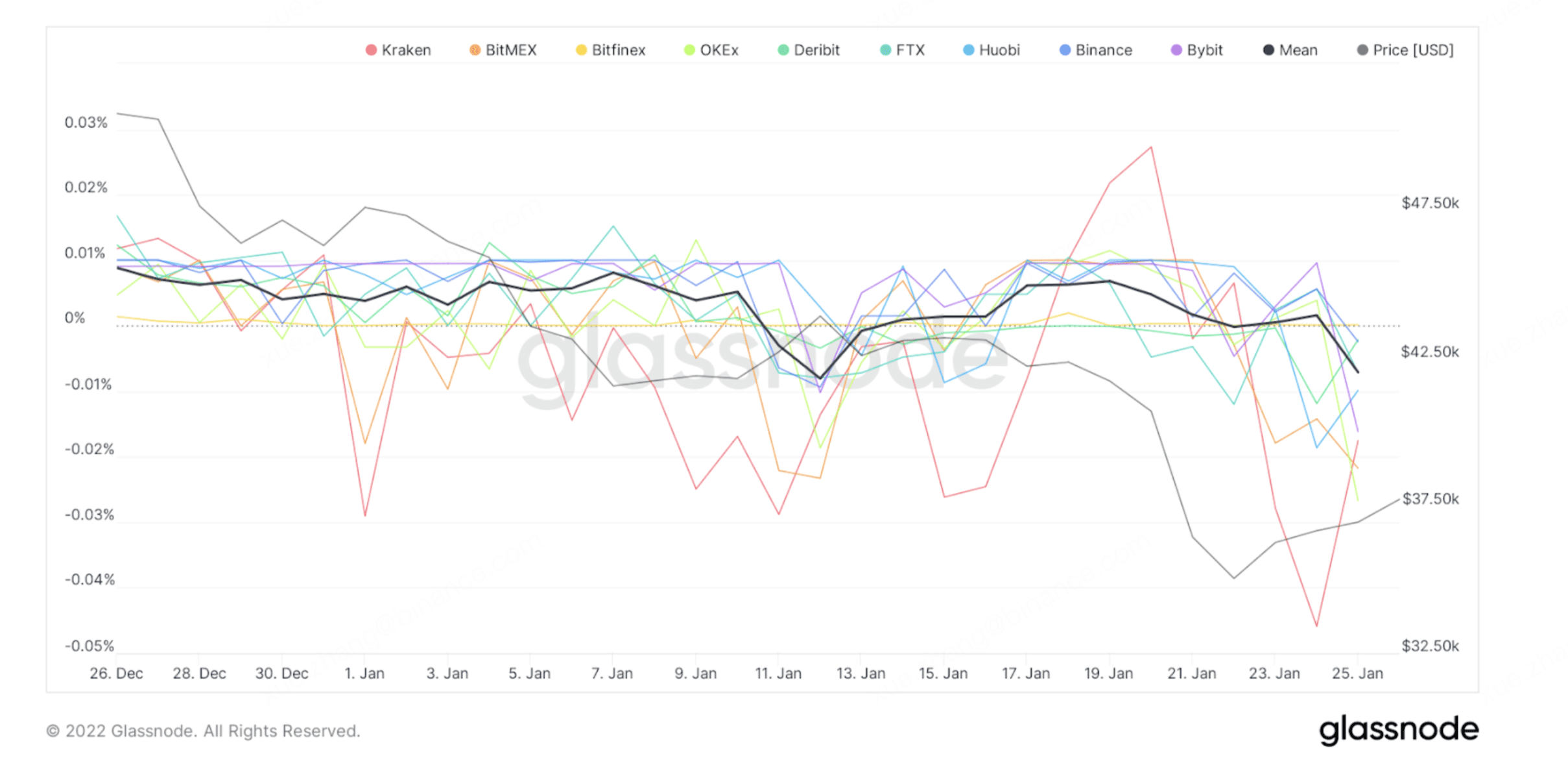

Currently, seven major exchanges offer perpetual contracts. In general, traders prefer platforms that provide the lowest funding rate, as this can have a significant impact on profits and losses. Here is a quick comparison of Bitcoin futures funding rates on different major exchanges:

Graph 2: in a period of 30 days the historical financing rate in the main platforms

Overall, funding fees averaged 0.015% across major exchanges. As mentioned, these rates typically vary based on changes in the price of the asset in question.

According to Skew, Binance Futures’ historical funding rates are lower than the industry average, averaging 0.0094%. For example, a trader pays 9.4 USD for a 100,000 USD position on Binance Futures, while on other platforms the funding rates can be 10% to 20% higher.

How does Binance Futures keep a low funding rate?

One of the main reasons Binance Futures has been able to maintain a low funding rate is due to the ease of arbitrage.

The crypto markets never sleep. Therefore, arbitrage opportunities exist continuously. Binance Futures allows traders to switch between spot and futures markets quickly and easily, allowing them to take advantage of these opportunities.

As such, inefficiencies between perpetual contracts and the mark price are arbitrarily eliminated, resulting in a narrow spread between the two prices. Although extreme volatility can cause occasional spikes in funding rates, arbitrage allows these opportunities to be seized quickly. Thus, the funding rate eventually returns to its mean.

On other exchanges where arbitrage is more restrictive, funding fees tend to be higher. This is due to restrictive trading between the Spot and Futures markets. For example, some exchanges limit the number of transfers that can be made in a single day.

Conclusion

Crypto funding rates play an important role in the perpetual futures market. Most crypto derivatives exchanges employ a funding rate mechanism to keep their contract prices in sync with the index at all times. These rates vary as asset prices turn bullish or bearish, and are determined by market forces.

Additionally, funding fees also vary between exchanges: on some, these fees remain consistently high. In contrast, other exchanges like Binance Futures maintain a low funding rate. This is mainly due to the different functions of exchange trading platforms. On exchanges that allow an easy transition between spot and futures markets, arbitrage is easier for traders. Therefore, shortcomings are quickly eliminated.

Go to Binance’s Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...