Tezos (XTZ), the liquid Proof of Stake protocol in the spotlight.

When it comes to DApps and NFT, Ethereum faces some competition: Tezos (XTZ) is an increasingly popular protocol with its signature on-chain governance and is preferred by artists like Doja Cat and Mike Shinoda.

The truth is that there are many investors who have been familiar with this blockchain and its native XTZ token for a long time.

Today we learn more about Tezos (XTZ).

What is Tezos (XTZ), in a nutshell

DApps and NFT have been gaining ground in the digital arts, both for the financial opportunities they provide and the use cases they offer.

With more than 130 projects and DApps running on its blockchain, Tezos has been gaining fame as the favorite platform for artists.

And that’s not all: Tezos’ NFT platform OneOf has announced that it will collaborate with the Grammy Awards and launch NFT to commemorate the 64th, 65th and 66th editions.

However, the protocol already enjoyed a great reputation in the cryptocurrency space, as it comes with a whole set of features that are unique.

In fact, this open source blockchain protocol is powered by a Liquid Proof of Stake consensus algorithm and can take pride in its on-chain governance, which is quite unique and allows for democratic and automatic updates on the network.

Tezos skills in detail

“Liquid” Proof of Stake

Unlike Bitcoin and, for now at least, Ethereum, which are based on a Proof of Work, the consensus mechanism that Tezos relies on is a Proof of Stake, also known to some as liquid Proof of Stake.

After the Granada update of the network that took place in August 2021, the previous algorithm, dubbed Emmy + at the time, underwent some major changes, and is now called Emmy *.

With the update, Tezos reduced its gas consumption by 50% and the block creation time also decreased from 60 to 30 seconds.

How does this “liquid” Proof of Stake work?

In the Tezos network, validators are called “bakers”. Users can become bakers if they make a minimum stake of a “muffin” (rolls in English), which is equivalent to 8,000 XTZ, and originally had been 10,000 XTZ.

The more muffins, the greater the probability of being selected for the creation of the block.

Aside from the low gas commissions and block creation time, which are fairly common characteristics of blockchains employing PoS, such as Solana (SOL), the Tezos consensus algorithm has a unique feature that earned it the Name of “liquid” Proof of Stake: its special and fluid use of the delegation.

Tezos users who do not have a minimum of XTZ to participate in the creation of blocks as bakers, or who own it but lack the necessary infrastructure to create blocks effectively, have the opportunity to delegate their coins in a Baker.

This type of delegation does not transfer ownership of the coins from a user to a baker, but rather resembles the act of lending.

Bakers who accept the delegation and are chosen for the creation of blocks will have to share their rewards with the users who “loaned” them the coins.

As opposed to a delegated Proof of Stake, “regular” and “delegate” bakers coexist and everyone can participate in block creation. Simply put, there is no delegate pool, as in traditional delegate PoS.

Chain governance and self-modification

Other singularities of Tezos are its governance in the chain and its rule of self-modification, qualities to promote scalability, decentralization and collaboration in the network.

In fact, bakers can not only create blocks, they can also vote to approve or reject adjustments or amendments in the protocol. The initial quorum required to determine the outcome of a vote is set at 80%, but is subject to change based on average turnout.

When disruption to the Tezos network is approved by the bakers, it is automatically implemented on the blockchain through smart contracts. This is the process that has earned Tezos the title of self-modifying protocol.

Tezos’ on-chain voting system, combined with the self-modification feature, makes controversies and forks less frequent on the blockchain: each update is democratically voted on by the bakers and then executed via smart contracts.

This means that all updates and changes are democratically approved by the baking community, virtually eliminating the need for a fork.

Widespread adoption: Tezos in music, art, and institutions

Cryptocurrency fans may not be the only ones who have heard of Tezos lately.

In fact, the protocol has made quite a few headlines. Let’s look at some of the news that has brought Tezos to center stage:

In October 2021, the inhabitants of Neuilly-sur-Seine, in France, were able to vote digitally through the app based on Tezos Elections.

The vote concerned the choice of books in a public library and represented a great testing opportunity for Tezos use of Tezos blockchain technology in the voting system.

More and more traditional financial institutions are adopting decentralized financial solutions based on the Tezos blockchain. The most recent case is that of the Swiss Arab bank.

The institution has partnered with Tezos and will use the Tezos native currency and blockchain to offer digital assets to its clients.

Tezos is also one of the favorite options for musicians: the NFT OneOf platform, which runs on the Tezos blockchain, has been gaining popularity thanks to users such as Doja Cat, John Legend, Charlie Puth, The Kid LAROI and others.

The platform launched with an extraordinary volume of funding earlier this year.

Speaking of art and NFT, Tezos is also participating in the digitization of art and culture.

Another popular platform built on top of Tezos is Hic et Nunc, the NFT platform that was adopted by musician Mike Shinoda, and also by Manchester Whitworth Gallery, which coined a William Blake NFT to raise money for social projects.

The protocol is also active “in real life”: between November and December, Tezos will be part of the curatorship and will present an NFT Exhibition at Art Basel Miami Beach 2021.

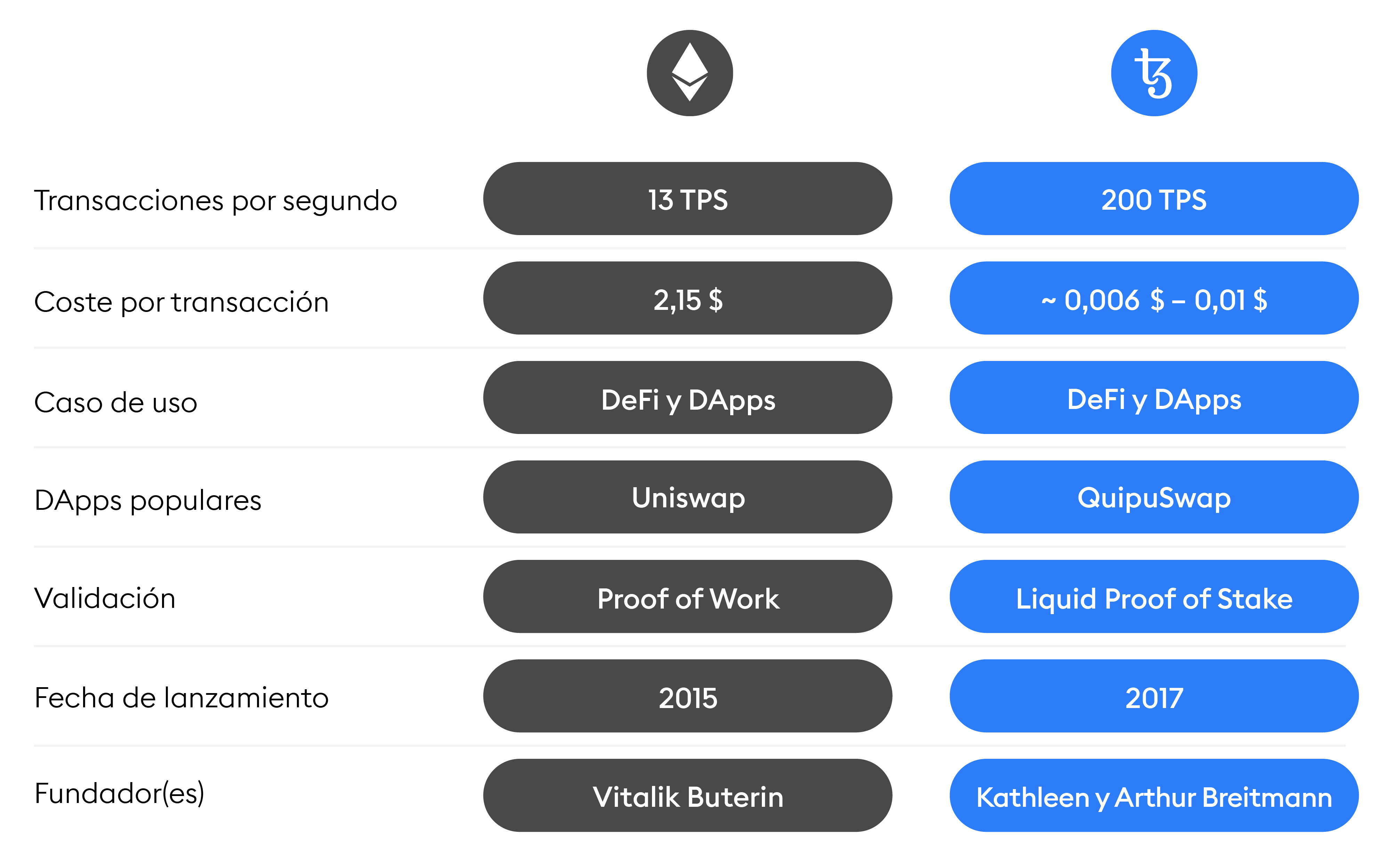

Tezos (XTZ) vs Ethereum (ETH)

With its growing popularity and its more than 130 projects and DApps, Tezos is growing more and more all over the world.

The question is: can it be compared to the crypto giant Ethereum, especially considering the considerable volume of ETH DApps? Let’s do a little comparison between XTZ and ETH.

How to start your research

When it comes to investing, research is critical.

For cryptocurrencies and altcoins, a good place to start is the official website for the asset you are researching, such as the official website for Tezos (XTZ).

Here you can better understand the projects, use cases and technical information of the protocol, and find even more things to learn.

How would a cryptocurrency be linked to your strategy? When you are researching a currency, you should ask yourself how that cryptocurrency would fit into your investment portfolio, and if you are leaning towards low risk and long-term investments, or are more comfortable with faster investments and (perhaps ) profitable, but higher risk.

Where can you buy XTZ?

At Bitpanda, XTZ is just a few clicks away on your smartphone or desktop, 24 hours a day.

Bitpanda’s easy-to-use interface makes investing in cryptocurrencies and other digital assets a breeze. Start investing today.

Please check Bitpanda official website or contact the customer support with regard to the latest information and more accurate details.

Bitpanda official website is here.

Please click "Introduction of Bitpanda", if you want to know the details and the company information of Bitpanda.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...