On Thursday, the main cryptocurrency market lost some of its recovery momentum after the Federal Reserve revealed that a 50-basis-point rate hike in May “will be on the table.”

Aggressive monetary policy has so far been a headwind to risk-asset investing.

Against this backdrop, BTC briefly approached $43,000 before pulling back to the $40,000 mark shortly after, erasing all of the gains of the past few days in the process.

At the time of writing, BTC is down 2.6% in the past 24 hours and is currently consolidating above $40,000.

Previous support near $41,000 also flipped into overhead resistance overnight.

Failure to clear the $41,000 resistance could see the largest cryptocurrency by market cap correct further to the $39,200-$40,000 area.

Despite short-term setbacks, several key on-chain metrics paint a positive path forward.

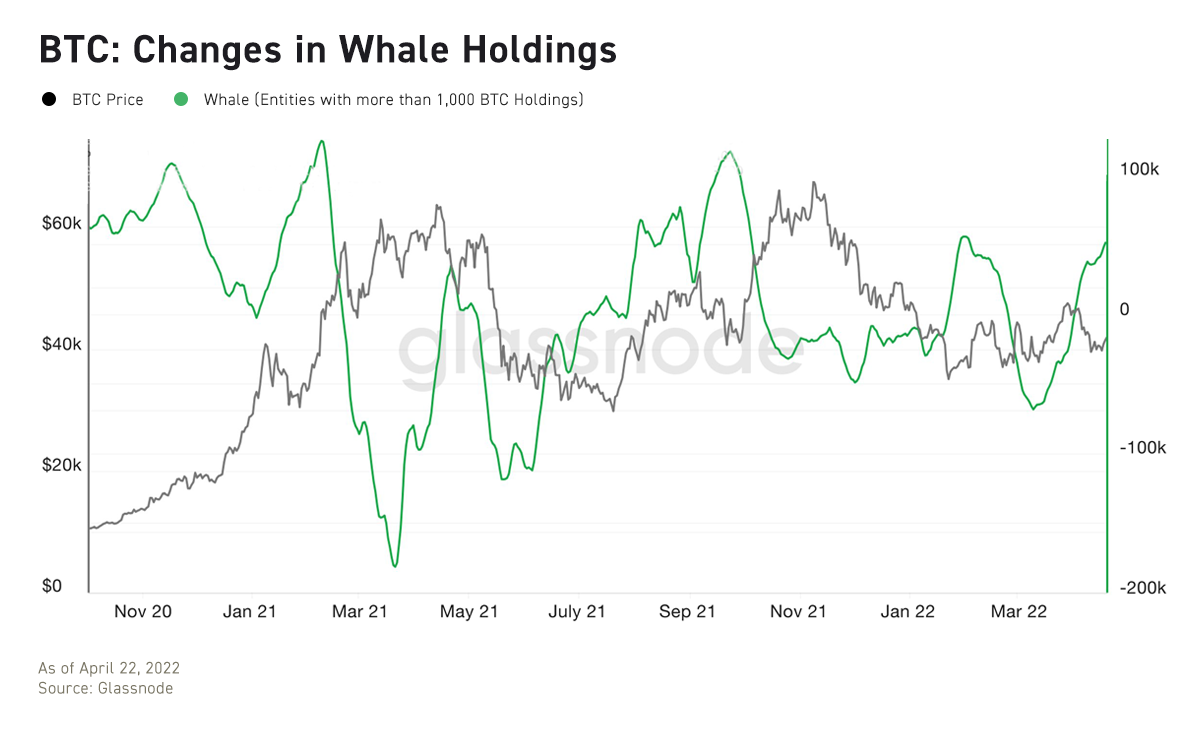

A chart detailing BTC holding data suggests that whales (addresses holding over 1,000 BTC) have been in a BTC hoarding phase for a month.

Changes in their holdings are rapidly approaching levels in late January of this year — a little after the market bottomed.

In the altcoin market, ETH has lost 3% of its value in a single day, and its current price is precariously trading above the psychological $3,000 mark.

Other major non-mainstream currencies are also in decline now, with NEAR leading the decline in this wave of altcoin downside corrections.

Fortunately, there is some good news in the market.

After Aave V3, an improved version of the money market protocol Aave, launched its liquidity mining program on Avalanche, its total locked value has soared recently.

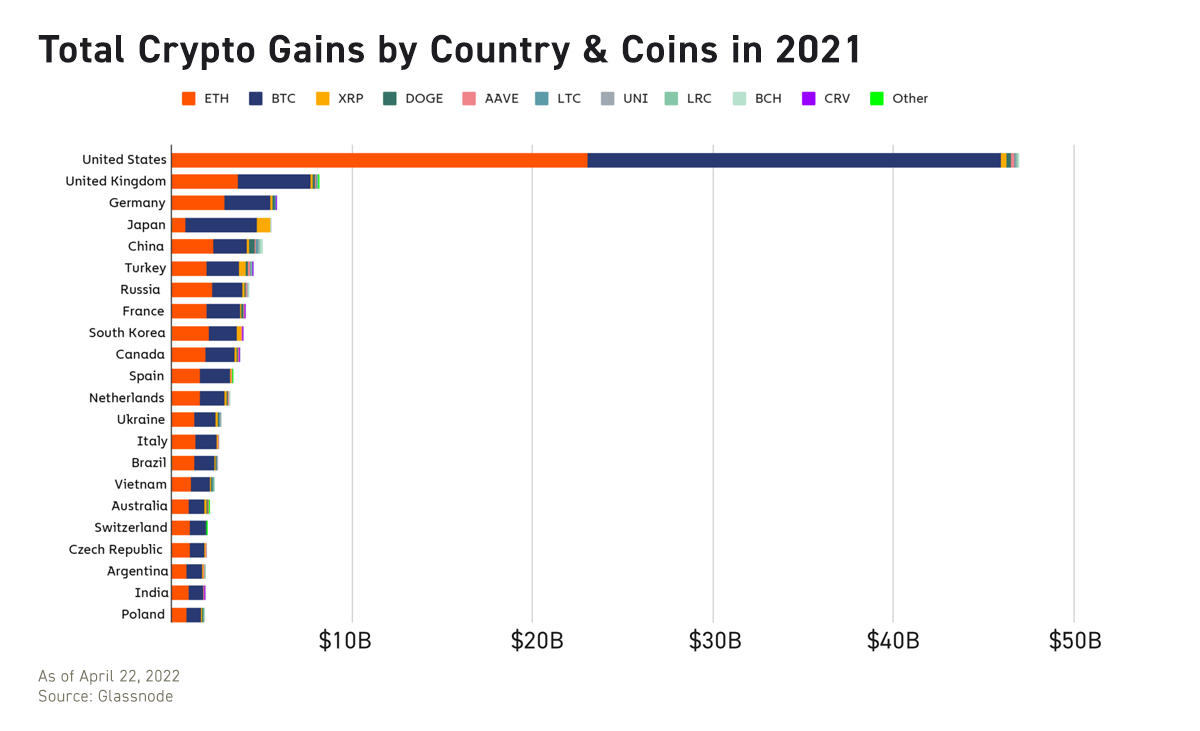

According to data from blockchain analytics firm Chainalysis, cryptocurrency investors have had a stellar 2021.

In fact, cryptocurrency investors have realized gains of around $162.7 billion in 2021, up a whopping 400% from the previous year.

Among these cryptocurrency investors, U.S. investors received 27% of the total return, or about $47 billion.

The Chainalysis report also noted that the vast majority (about 93%) of the gains came from BTC and ETH.

Go to PrimeBit Official Website

Please click "Introduction of PrimeBit", if you want to know the details and the company information of PrimeBit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...